Week 6: Overview of the world biodiesel market

BIODIESEL MARKETS:

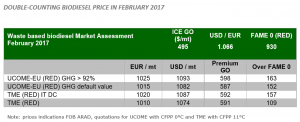

- Double-counting market remained relatively quiet in the last three weeks but activity seems to be back this week as around 25 to 30 KT have been traded by producers (per our estimation). Moreover, we expect the business to catch up in the coming weeks with the level of the Rhine going up enabling biodiesel supply to main German refineries and oil majors.

- Consequently, UCOME prices went down and are now traded around 1020-1025 euros per MT in ARA region for February and March deliveries. Prices have certainly reached a low point since most of the producers are now sold out for February and March.

- Nesté published its full financial statement for the year 2016. The report reveals that the renewable fuels division is now the most profitable in the company and that the company is evaluating investment possibilities in the US and in Singapore. Renewable business operating profits increased by more than 16% year-on-year to €469 million.

- Despite the end of the blender’s tax credit ($1/gallon) on the 31st December 2016, the United States continued to import substantial volumes of biodiesel products in January. For instance, Argentina, which remains by far the biggest supplying country, exported 45 million gallons (150 KT) in January 2017 to the US, more than 5 times the volumes exported at the same period last year. US market remains driven by high prices of biomass diesel, RINs credits and incentives in California to reduce carbon emissions.

- Nigeria’s Government is willing to foster the biofuels industry. They will invest $50 million in the hedge fund together with State companies and financial institutions such as the Bank of Agriculture and the Agriculture and Development Bank of Nigeria.

OIL MARKETS:

- Crude oil prices are relatively stable this week. WTI was up by 0.35% on Wednesday at $52.35 per barrel on higher than expected stocks in the US. On the same day crude oil Brent raised slightly above $55 per barrel.

- Major oil companies are adopting different strategies to face crude oil price recovery. BP and Exxon Mobil are starting to raise investments whereas Total will continue to cut down capital expenditures.

- Total’s investments are expected to be reduced by at least $0.5 bn year-on-year to $16bn- $17bn in 2017. Oil price of $50 per barrel will enable the company to cover its Capex and dividends whereas competitors such as BP would need $60 due to further investments.