Week 11: veg-oil prices drag UCO down

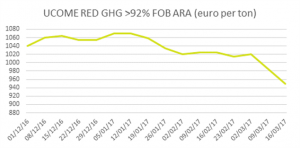

- UCO prices went down this week by 20-30 USD per ton CIF EU ports and were seen at levels between 750 – 770 USD per ton. The decrease in UCO prices follows a crash in UCOME prices that started earlier this month. Animal fat category 3 also followed the downward trend.

- The fall in the UCOME market is mainly due to a decrease in veg-oil prices and a fall of the price of crude oil. The liquidity of the market remains quite low.

- The downwards trend of UCO is however not as big as the fall of UCOME prices which puts pressure on the UCOME producers. The UCO price will have to correct further down to give some support to the UCOME market.

- Vegetable oil prices were down this week on last USDA report forecasting soybean production at a record level, increased palm oil production and the bearish trend of crude oil.

Palm oil

- Last Malaysian Palm Oil Board report confirmed that the Malaysian CPO production is recovering and increased 20% in February 2017 compared to the same month last year.

- However, stockpiles levels remain historically low due to last year’s weak production. The output recovery is not yet sufficient to rebuild the stockpiles in both exporting and importing countries. This is likely to create some pressure on the palm oil market but we should see all countries rebuilding their stocks over the second-half of 2017.

- From the beginning of February, Crude Palm Oil prices lost almost $100 per MT (down 13.7%) and are now traded at $708 per MT on average in Rotterdam.

Soybean

- Last USDA report showed a global soybean projected supply for 2016/17 at a record level of 340,79 million metric tons. This is mainly due to Brazil’s increased production forecast which has been revised up by 4 million tons to 108 million tons on favorable weather conditions.

- Nevertheless, last week, heavy rainfalls caused delays on the deliveries to the ports which put pressure on soybean’s prices.

- Besides, Brazil will increase its exporting capacity by around 20% or 5 million tons once the new port terminal in the city of Santos is finished. The terminal will be supplied by rail and not by trucks reducing logistics uncertainties.

Rapeseed

- The downward trend of soybean oil and palm oil (- 5% over the week) affected rapeseed oil prices in Europe (-2.5% over the week). Rapeseed oil is now traded at around $845 per MT on average in Rotterdam.

- European imports of rapeseed in January reached 666 KT, up by 92% year-on-year to compensate the low production of last year and the weak forecasts for this season.

- In Canada, since January, canola’s consumption is 1.4 M tons higher year-on-year even though production is said to have increased only by 1 M tons.