Week 3: Overview of the world biodiesel market

Biodiesel Markets:

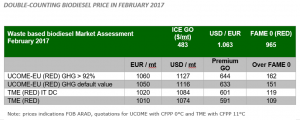

- We noticed lower activity on the UCOME market this week which is quite usual at this period of the year. Price offers from producers who are under constant pressure due to shortage of waste-based feedstock struggle to find adequate bids from buyers even if there is product on the market. Today, on the 20th of January we can still see around 25,000 MT available for February loadings. We can see the prices of UCOME going slightly down from 1080 euros per ton in December 2016 to 1050 euros (bids) in January 2017.

- The swings of gasoil did not help biodiesel sales over the week as well. From Monday to Tuesday prices increased by around 2.8% to almost $500 per MT after decreasing by 4.8% to around $477 per MT on Thursday (see oil market review below). And the volatility of the EUR/USD does not help the European transactions of DC Biodiesel either. The exchange rate came back to the level of 1,06.

UK and the US:

- The implementation timeline of all these measures remains open since Theresa May specified that a transitional period would need to be negotiated with the European Union.

- UK Prime Minister, Theresa May, specified at a press conference UK’s Brexit guidelines. The British Government is taking a hard line approach to cut all ties with the European Union. The final plan will be put to a vote in the Parliament and if the vote is favourable, the country will be out of the single market in near future. That could mean introduction of import duties of 6.5% for biodiesel.

- The Brexit scenario is raising many questions about the future of the UK UCOME market. Will it remain one of the largest markets for DC Biodiesel and the biggest importer from Europe? We note that in week 2 only, 47,510 tons of UCOME were reported to have been shipped to the UK. With Brexit becoming reality the support of DC biodiesel coming from Europe or overseas does not seem very probable but we have to wait and see how the government will react…

- Today is also the day of Donald Trump’s inauguration as US president. This also adds uncertainty to the world biofuels market as the policy of the new president towards biofuels is not very clear. He might want to focus more on the local market putting in question the HVO imports from Singapore, for example. As a result, the US might become a rather closed market but, as with Brexit, let’s see what the future will bring.

Oil Markets:

- The International Energy Agency revised its forecast for oil demand in 2017. They estimate a decrease to around 1.3 million barrels per day, down from 1.5 million in 2016. This is mainly due to higher expected prices after the agreement on global production’s cap and a stronger dollar.

- This week crude oil WTI fell under the level of $52 a barrel as markets had concerns about the OPEC’s intention to cap global production and about an increasing oil production in the US caused by shale gas exploitation.

- Brent prices followed this trend and fell also by 2.8% to close at $53.9 per barrel on Wednesday. They recovered slightly to around $54.2 on Thursday.